Special Request for Information: CAPC Wants to Hear From You

The following is a special request for information from any providers participating in the PQRS. If you would like to share your thoughts, please contact Stacie Sinclair at [email protected].

CAPC Soliciting Input on Payment under Federal Quality Reporting Programs

On October 1, CMS released a Request for Information (RFI) that asks stakeholders for their feedback on the implementation of future quality reporting programs that will affect Medicare payment. CAPC is interested in hearing from the field how the current programs and upcoming changes affect palliative care providers. This information will help inform comments that we may submit to CMS for this and future opportunities.

Background

To help accelerate the transition from volume to value, Congress recently passed the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA). A key provision of the MACRA requires eligible professionals (EPs) serving Medicare patients to select one of two options if they hope to avoid negative adjustments to their Medicare fee-for-service payment rates: 1) Participation in the Merit-based Incentive Payment System or 2) Participation in Alternative Payment Models—models that involve shared financial risk between payers and providers.

Merit-Based Incentive Payment System (MIPS)

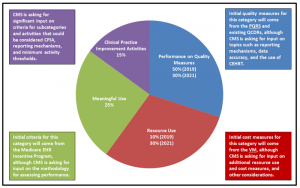

CMS is responsible for developing the specifications for the MIPS. At the most basic level, the MIPS will incorporate quality measures from three existing quality programs (the Physician Quality Reporting System (PQRS), the Value-Based Payment Modifier (VM), and the Electronic Health Records (EHR) Incentive Program), along with additional quality measures and activities, to calculate a composite score on a scale of 1-100. CMS will use the categories in Figure 1 to calculate the score. It will then use this score to make positive or negative payment adjustments reaching up to nine percent in 2022 and beyond, based on a performance threshold calculated each year.

Figure 1. MIPS Categories and Comment Opportunities

Alternative Payment Models (APMs)

To incentivize participation in APMs, CMS will award five percent bonuses to EPs who participate in an APM that requires the use of certified EHR technology, ties payment to quality measures comparable to those included in the MIPS, and bears a certain level of downside risk. In 2019 and 2020, only EPs who receive at least 25 percent of payments made through Medicare APMs will be eligible for the incentive;[1] in 2021 and beyond, EPs may select either a Medicare payment threshold option, or a combination all-payer and Medicare payment threshold option.

What CMS is Asking For

CMS is seeking public and stakeholder input to inform the implementation of MIPS and APMs. CAPC has identified the following topic areas as particularly relevant for our field:

MIPS – § II(A)(3)(a) Reporting Mechanisms Available for Quality Performance (p. 59105). Questions in this section include whether the current reporting mechanisms under the PQRS are sufficient, whether the minimum number of quality measures is appropriate, and whether certain measures should be weighted differently.

MIPS – § II(A)(3)(b) Data Accuracy (p. 59105). Questions in this section include input on the level of scrutiny that non-CMS managed reporting mechanisms (e.g., the QCDR) should be subject to, and how CMS should assess EPs whose submissions do not meet data integrity requirements.

MIPS – § II(A)(4) Resource Use Performance Category (p. 59106). Questions in this section include whether CMS should consider any additional resource use or cost measures for the program and how CMS can align cost measures under the VM with other Medicare cost and quality measures.

MIPS – § II(A)(5) Clinical Practice Improvement Activities Performance Category (p. 59106). Questions in this section include what activities could be considered CPIA, how these activities should be reported, and how CMS should assess performance on CPIA.

APMs – § II(B)(1)(f) Regarding EAPM Entity Requirements (p. 59111). Questions in this section include what entities should be considered eligible alternative payment entities and what criteria should be used to determine comparability to MIPS quality measures.

APMs – § II(B)(2)(b) Criteria for Physician-Focused Payment Models (p.59112) . Questions in this section include what criteria should be used to assess physician-focused payment models, and if these should be modified for specialist models.

Call to Action

CAPC’s policy priorities include ensuring that palliative care is given due consideration as we move toward payment for value, and it is critical that we understand how these new quality programs can help effect a more patient-centered healthcare delivery system. This RFI presents an opportunity to provide CMS with feedback about the structure of the MIPS and APMs before it solidifies many of the details. If you have any comments on the topic areas above, would like to share your challenges submitting data under the current quality reporting programs, or have suggestions on how to improve providers’ ability to participate, CAPC wants to hear from you! Please contact Stacie Sinclair at [email protected].

Alternatively, we encourage you to review the RFI in its entirety and submit your comments directly to CMS. The comment period closes at 5:00pm ET on November 17, 2015.

-

Although the payment adjustments for participation will not be applied until 2019, MACRA has already identified several existing Medicare programs that will qualify as an APM: 1) A demonstration under Section 1115A of the Social Security Act (SSA) (i.e., demonstrations from the Center for Medicare and Medicaid Innovation such as the ACO model), with the exception of any programs under the health care innovation award; 2) A demonstration under the Medicare Shared Savings Program (Section 1899 of the SSA); 3) A demonstration under the Health Care Quality Demonstration Program (Section 1866C of the SSA); or 4) A demonstration required by Federal law.